Example Explaination Pennsylvation Return Taxable Wages Different From Federa

Before reviewing the exact calculations in the 2600000 after tax salary example it is important to first understand the setting we used in the US Tax calculator to produce this salary example. If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty.

Pennsylvania Employment Tax Tutorial

State Income Tax vs.

. Example During the tax year Tina earned income from both a full-time and a part-time job. If you earn more than 400 through self-employment including royalties you must report that income on your tax return. Once you retire and begin to receive pension benefits you will pay tax on your retirement payments on your federal return.

Yes income from illegal activities like drug dealing is taxable income. Every resident part-year resident or nonresident individual must file a Pennsylvania Income Tax Return PA-40 when he or she realizes income generating 1 or more in tax even if no tax is due eg when an employee receives compensation where tax is withheld. Her return will list her wages as the total of the amounts in Box 1 but each Form W-2 must be.

It is important to also understand that this salary example is generic and based on a single filer status if you are looking for a precise. W-2 Wage and Tax Statement Explained. However most wages that you pay out to your employees are taxable.

He incurred allowable vehicle and travel. If you had 50000 of taxable income youd pay 10 on that first 9950 and 12 on the chunk of income between 9951 and 40525. Responding to employee W-2 inquiries is much easier once you know the pay elements used to determine the taxable wages on the W-2.

Dave earned compensation of 30000. If too much is withheld you will generally be due a refund. Before reviewing the exact calculations in the 7700000 after tax salary example it is important to first understand the setting we used in the US Tax calculator to produce this salary example.

According to IRS Publication 17 Federal Income Tax Guide for Individuals taxpayers must report this income as self-employment activity and the eFile Tax App will report this on the 1040 form on line 8z or on Schedule C of the tax return. Return of Partnership Income. The explanation which follows reflects only.

And then youd pay 22 on the rest because some. Complete a new Form W-4 when changes to your personal or financial situation would change the entries on the form. Another example is use of a company car.

For example if payments for moving expenses were provided that amount would be added into the taxable wages in order to calculate the final tax amount. You report these on Schedule C of IRS form 1040. And has a link to Form 1065 US.

Although there is no blanket equation for royalty taxes typically royalties received from your work are reported as self-employment income and are taxed at a higher rate. The taxable income formula for an organization can be derived by using the following five steps. Non-taxable wages are wages given to an employee or individual without any taxes withheld income federal state etc.

The IRS definition of a non-taxable wage and other tax-exempt income is fairly narrow. For more information on. If a reimbursement is more than the allowable expenses the excess must be reported as taxable compensation on Line 1a of the PA-40 Personal Income Tax Return.

That difference is particularly important for tax purposes as in most cases earned income and unearned income are taxed differently. Its calculated by taking your gross income the total amount of money that youve gotten from any source of income during a tax year and subtracting any deductions and exemptions that you can claim. Taxable income is essentially any money someone has received thats subject to income tax.

It is important to also understand that this salary example is generic and based on a single filer status if you are looking for a precise. Taxable wages are salaries paid to an employee that by law must have taxes withheld. Next the operating expense is also calculated from the accounts department.

Your W-2 Wage and Tax Statement itemizes your total annual wages and the amount of taxes withheld from your paycheck. Firstly gross sales have to be confirmed by the sales department. Most likely the difference between the federal and state compensation is the amount you contributed toward an employer sponsored pension plan which is excluded from tax on your federal return but not on your state income tax return.

2022 US Tax Calculator. When your W2 PA wage information differs from federal wage information the W2 Reconciliation worksheet PAW2RWK is used to reconcile Federal Medicare and PA wages to figure the amount of compensation to carry to the PA return. If an employer does not provide reimbursement an employee may compensation by the allowable expenses actually incurred.

For Married Individuals Filing Joint Returns Taxable Income For Heads of Households Taxable Income. Refer to the below section on TAXATION for additional information. Next the cost of goods sold is determined by the accounts department.

The W-2 form is a United States federal wage and tax statement that an employer must give to each employee and also send to the Social Security Administration SSA every year. Alternatively there are non-taxable wages that is not subject to tax withholding. The state has 10 tax brackets for 2022 starting with a 1 bracket for income up to 9325 and ending with a 133 tax rate for income in.

Has a multitiered income tax system under which taxes are imposed by. Next the interest paid is calculated based on. 2022 US Tax Calculator.

Correct federal income tax from your pay. When there is a difference between the PA State wages and the Federal and Medicare wages that cannot be explained from the data entered on. Earned income is subject to federal state and in some cases.

She received two Forms W-2 each listing different employers.

8 Years Resume Format Resume Format Federal Resume Job Cover Letter Resume Cover Letter Examples

Jeannieborin On Twitter Yahoo News Finance Sayings

What Is Local Income Tax Types States With Local Income Tax More

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

10 Tax Tips For People Working And Living In Different States Howstuffworks

Fully Remote Worker Income Tax Withholding Considerations Rkl Llp

Financial Calculators From Financial Calculators Inc Dba Calcxml Financial Calculators Savings Calculator Financial Decisions

Download Best Of Cover Letters For Jobs Samples Lettersample Letterformat Resumesample Resumeformat Federal Resume Job Cover Letter Resume Examples

Pennsylvania S Complicated History With Bonus Depreciation Bloomberg Tax

How Bonuses Are Taxed Turbotax Tax Tips Videos

2021 2022 Tax Brackets Rates For Each Income Level

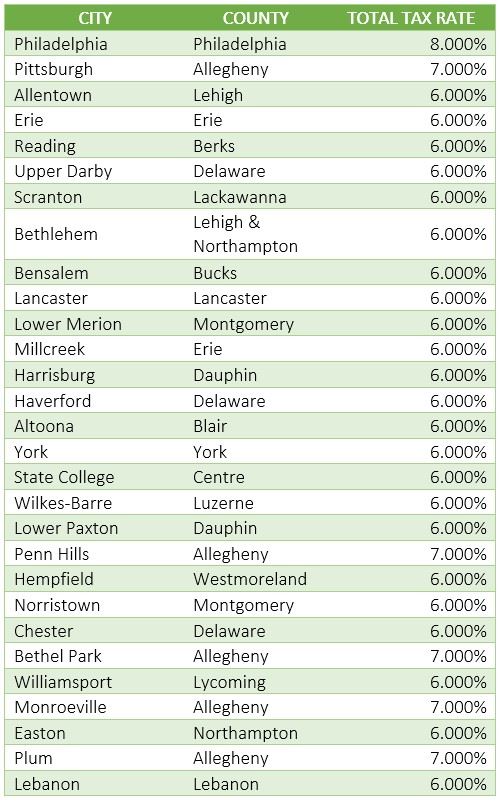

Pennsylvania Sales Tax Guide For Businesses

Tax Rates And Income Brackets For 2020

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Capital Gains Losses And Child Support Obligations

If You Live In Pennsylvania These Tax Rules Might Help You Save On Taxes

What Is Taxable Income And How To Calculate It Forbes Advisor

.png)

Comments

Post a Comment